By Thornical Press –

January 15, 2026

The story of Goldman Sachs is more than just a corporate history; it is a mirror of the evolution of modern capitalism. For over 150 years, the firm has navigated industrial revolutions, world wars, market crashes, and the digital age. From its humble beginnings in a basement office to its status as one of the world’s most influential financial institutions, Goldman Sachs has been defined by its ability to adapt, innovate, and, at times, court controversy.

The firm was founded in 1869 by Marcus Goldman, a German-Jewish immigrant who had arrived in the United States decades earlier. Operating out of a small office on Pine Street in Lower Manhattan, Goldman’s business was simple: he acted as a middleman in the commercial paper market. He would buy promissory notes from local merchants—jewelers, tanners, and wholesale grocers—and resell them to banks for a small profit. In its first year, Goldman single-handedly transacted $5 million in paper.

The “Sachs” half of the name arrived in 1882 when Marcus’s son-in-law, Samuel Sachs, joined the business. By 1885, with the addition of Marcus’s son Henry and son-in-law Ludwig Dreyfuss, the firm adopted its enduring name: Goldman, Sachs & Co. During this era, the firm was a family-run partnership, a culture of interconnected families that would persist for nearly 130 years.

As the American economy transitioned from small trade to massive industrial conglomerates, Goldman Sachs evolved. In 1906, Henry Goldman led the firm into the underwriting business, co-managing the Initial Public Offering (IPO) of Sears, Roebuck & Co.

This was a revolutionary moment. At the time, companies were typically valued based on their “hard assets”—land, buildings, and machinery. Goldman Sachs pioneered the concept of valuing companies based on their earning power and “goodwill.” This innovation allowed retailers and service-oriented businesses to access capital markets, and it popularized the use of the price-to-earnings (P/E) ratio, a metric that remains fundamental to finance today.

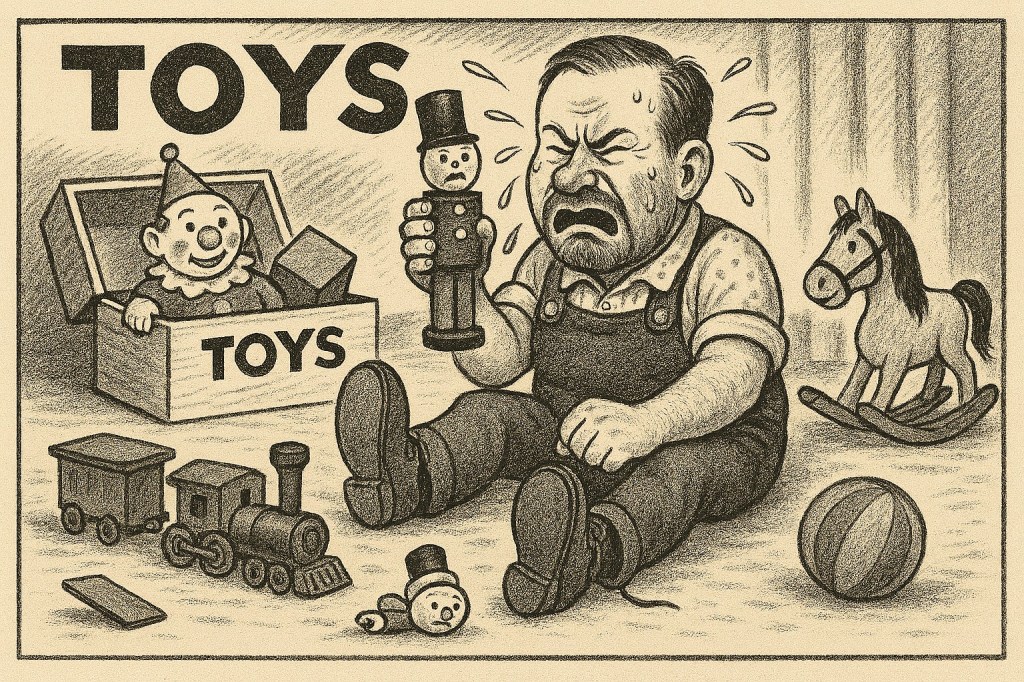

The 1920s were a period of unbridled optimism, and Goldman Sachs was not immune to the speculative fervor. In 1928, the firm launched the Goldman Sachs Trading Corporation, a closed-end investment trust that used high leverage to invest in the market. When the stock market crashed in 1929, the Trading Corporation collapsed, losing nearly all its value and severely tarnishing the firm’s reputation.

The crisis led to the departure of partner Waddill Catchings and the rise of Sidney Weinberg, a man who would become known as “Mr. Wall Street.” Weinberg, who started at the firm as a janitor’s assistant, took over in 1930 and spent the next three decades rebuilding the firm’s integrity and focusing on client relationships.

Under Weinberg’s leadership, Goldman Sachs shifted its focus toward corporate advisory and investment banking. He cultivated a “long-term greedy” philosophy—the idea that the firm should prioritize its reputation and client success over short-term profits.

A landmark victory occurred in 1956 when Goldman Sachs co-managed the IPO of the Ford Motor Company. Raising $657 million, it was the largest IPO in history at the time and cemented the firm’s position as the premier advisor to Corporate America. During this period, Gus Levy also joined the firm, pioneering “block trading”—the practice of buying and selling massive quantities of stock at once—which gave the firm a formidable edge in securities trading.

The 1970s and 80s were marked by rapid expansion. Following the leadership of “the two Johns”—John L. Weinberg and John C. Whitehead—the firm opened offices in London and Tokyo, becoming a truly global entity.

In 1981, the firm made a strategic move by acquiring J. Aron & Company, a commodities trading firm. This acquisition brought a new culture of risk-taking and quantitative analysis to the firm, introducing future leaders like Lloyd Blankfein and Gary Cohn. It also diversified Goldman’s revenue away from traditional advisory fees toward more volatile, but lucrative, trading profits.

For over a century, Goldman Sachs had remained one of the last major private partnerships on Wall Street. However, the increasing capital requirements of global trading and the need for a public currency to make acquisitions made the partnership structure a liability.

After years of intense internal debate, the firm went public on May 4, 1999. The IPO raised $3.66 billion and transformed the firm into a shareholder-driven corporation, though many argued it also marked the end of its unique, insular culture.

The 2008 global financial crisis was a watershed moment. While competitors like Lehman Brothers collapsed and Bear Stearns was forced into a fire sale, Goldman Sachs survived, aided by a $10 billion injection from the U.S. government’s TARP program and a $5 billion investment from Warren Buffett.

However, the firm emerged from the crisis as a lightning rod for public anger. It was famously described by journalist Matt Taibbi as a “great vampire squid wrapped around the face of humanity.” Legal scrutiny followed, including a $550 million settlement with the SEC in 2010 over the sale of subprime mortgage products. To increase stability, the firm converted into a bank holding company, bringing it under the direct supervision of the Federal Reserve.

In recent years, under the leadership of David Solomon, Goldman Sachs has sought to diversify beyond its “Main Street vs. Wall Street” divide. The launch of Marcus by Goldman Sachs in 2016 marked the firm’s first foray into consumer banking, offering personal loans and high-yield savings accounts to the general public.

Today, the firm continues to navigate a landscape of fintech competition, ESG (Environmental, Social, and Governance) investing, and shifting global regulations. Despite the controversies and the evolution of its business model, the core mission remains the same as it was in 1869: sitting at the intersection of capital and ideas, moving money to where it can be most productive.

The history of Goldman Sachs is a testament to the power of financial innovation and the resilience of a culture that, for better or worse, remains the most envied and scrutinized on Wall Street.